The 50/30/20 Budgeting Method

This post may contain affiliate links, meaning we get a commission if you decide to purchase through our links at no cost to you. This helps fund Slower Travels without costing you a cent!

If you’re new to budgeting or just looking for a super simple template, you can’t go past the 50/30/20 rule. We recommend this as the first step as it gives you a great overview of where you’re sitting in terms of your spending. And it also can give you a nudge in the right direction as you get started.

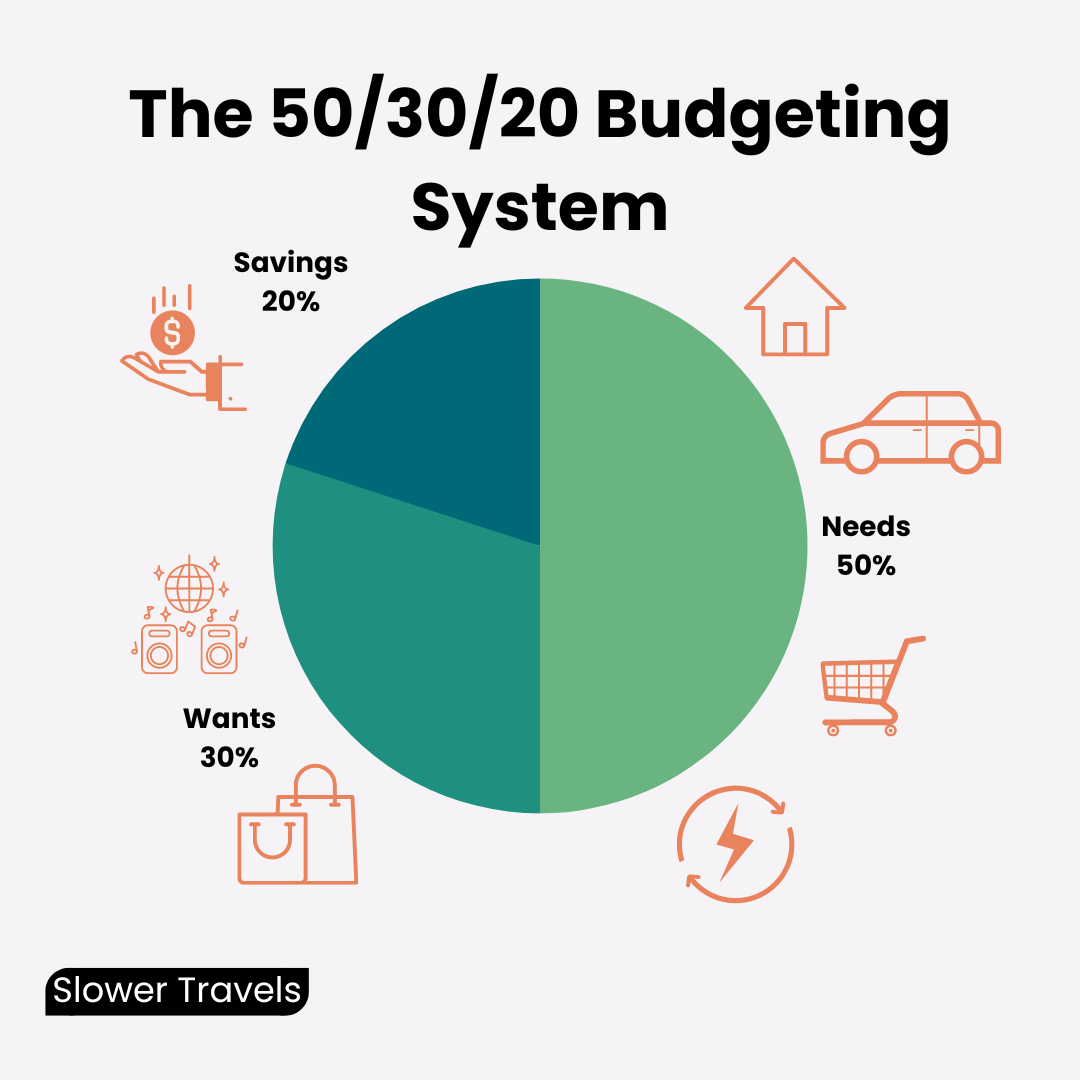

What Is the 50/30/20 Rule?

To keep your budget simple, this process divides your income into three categories: Needs, Wants, and Savings. And you want these to respectively equal 50, 30, and 20% of your income. It’s a tried and tested method of budgeting that makes sure your needs are covered but leaves you some money to invest or save each month. Remember, compound interest is your friend so even small amounts being put away each month will add up over time.

How To Get Started

I am all about being able to take instant action. So rather than beginning tracking your spending today, I would recommend looking backward at previous expenditures. If you’re anything like me, you pay for everything with a card so it’s relatively easy to go back over your bank statements and see where everything sits.

I would recommend looking at at least a month’s worth of expenses. A week isn’t going to cover things that you pay monthly, like utilities. You also might want to think about annual payments that you make, but we’ll come back to this later on. Keep it simple, to begin with, and just look at what you spent and label it as either Need, Wants, or Saving.

How Do You Define Needs, Wants and Savings?

This is where you can have some flexibility. Obviously Needs would usually include rent or mortgage, utilities, cellphone provider, debt repayments, and groceries. Wants are things like dinners out, alcohol, clothing, and entertainment. Savings includes retirement funds, savings accounts, and investments.

But this is your budget, so you have the final say as to what sits where. You might define clothes you buy for work as a Need. Your streaming services might be seen as Needs or Wants, depending on your definitions. It’s up to you to decide, but ultimately I would recommend trying to keep your list of what sits under Needs as narrow as possible.

Additional Items To Consider

There are some things that you may pay for annually. For me, these might be registering my car, insurance, and credit card fees. Again, it should be relatively easy to figure out what they are from previous bank statements or receipts. Then divide them by 12 and add them to their respective categories to give you a more accurate picture.

Simple Math

Once you know your categories, you can go over your bank statements and add up how much you’re spending in each bucket. The first goal should be to have these add up to less than your monthly earnings. Living within your means ensures that you’re not going into debt, you have the ability to save and pay less for items by not being charged interest.

Then look how close you are to the goal of 50% Needs, 30% Wants and 20% Savings. If you’re just starting out or have debts to repay, you might not be putting anything into savings just yet. Or your Wants might be quite high if you’ve never paid much attention to what you're spending. Don’t be too harsh on yourself at this stage. This is just information gathering to see where you’re at so that you can start moving forward.

What Does It Mean?

Having knowledge of where your money is going is powerful. And sometimes confronting. Realising just how much money we were spending on food in our first few months abroad definitely was. Perhaps you’re realising how big of a chunk your rent or mortgage is taking up of your salary. Or how much you really are spending on Sunday brunches. But this simple formula gives you a goal to work towards. Remember, reducing one category will change the balance between the three and get you closer to the magic numbers.

An Example

I’m a geek who loves a spreadsheet, so I went back and had a look at our budget for January 2020. This is how we broke down our earnings into this budget. Keep in mind that this was the joyous time of pre-Covid when you could have dinners out. You’ll notice we’d already reduced our Wants dramatically as we were saving to purchase our apartment.

Needs: 45%

This includes bank fees, bus passes, car insurance, car repayments, car servicing, contents insurance, electricity, groceries, internet, life insurance, mobile phone, petrol, car registration, rent and water.

Wants: 22%

This includes a gym membership, fitness classes, clothing, dinners out, drinking and trading software.

Savings: 31%

At this point, we’d already signed to purchase a new apartment. We had a big savings goal to meet when we were due to settle on the property, so we’d already done quite a lot of work to start getting this figure up to $4,000 a month. You’ll notice we did this by reducing our Needs and Wants well below the recommended 50% and 30%. It can be done.

Next Steps

Like where you’re sitting compared to those magic numbers? Or have a way to go to hit your financial goals? You might want to consider a budget that’s a bit more detailed so you can see a little more where your money is going and where you might want to cut back.

Or see where you could make some quick wins to help bring some balance in. Maybe skip the mall this weekend or cancel some of those subscription services you no longer use. Sometimes just being more mindful can help set you on a better path. Try being more conscious of your spending for a month and come back and revisit this process to see where you’re sitting. Check out some more of our tips on how to reduce expenses here.